Property tax calculator

The following property tax calculator will help you determine how much tax you will pay for your house.Guidelines to follow when using the property tax calculator

1. First, enter the market value.

The market value is what your house or property is worth on the open market.

2. Second, enter the assessed value of your property as a percent.

The assessed value is a percent of the market value. The state may decide that the assessed value is 50% of the market value. That is half the selling price of the house.

The lower the assessed value, the lower your property tax. As a result, happy you!

If your assessed value is 100, that means the government will use the market value. Not good for you!

3. Finally, enter the tax rate.

The calculator does not take into account exemption that you may have been granted. In many cases, exemption will be given to you that will help you lower your taxes even more.

A real life example showing how to use the property tax calculator

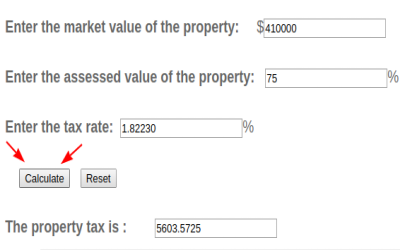

In 2019, the market value of a property in Hillsborough county, Florida was 410,000, the assessed value was 307500 dollars, and the total millage rate was 18.2230. If the property received no exemption in 2019, what is the total ad valorem taxes?

Enter 410,000 in the field that says "Enter the market value of the property."

Now, you need to compute the assessed value as a percent. Just divide 307500 by 410000.

307500/410000 = 0.75 = 75%

Enter 75 in the field that says, "Enter the assessed value of the property."

Do not enter the % sign!

The millage is 18.2230 and 18.2230 is the amount for every 1000 dollars. We need to convert this to a percent first. The percent amount is 1.82230%

Just enter 1.82230 in the field that says, "Enter the tax rate."

As a rule of thumb, just divide the millage by 10 to convert it into a percent.

Once you do that, hit the button named calculate and the answer will display.

Ouch! It seems like one needs to do a little bit of math to use this property tax calculator. Well, here is a property tax calculator where all you need to do is to enter the assessed value and it will estimate your tax based on average county tax rate. Be careful tough with this calculator! I used it to estimate my property tax and the number was off by about 1500 dollars.