Want to see how your math skills can be used in the field of actuarial science? Become an actuary!

Introduction to the field

It is not easy to become an actuary, but if you do become one, you are on your way to a very rewarding career that uses math all the time. But who exactly is an actuary?

An actuary is someone who is mostly employed in the insurance industry to manage risk. Others work in actuarial consulting firms. A very low number of actuaries work for government agencies, and computer software developers.

Every person or organization faces risk. As experts in measuring and managing risk, actuaries fill and play a significant need in our society. Their contribution to society's psychological, physical and economic well-being is immense.

If actuaries didn't exist, our economy would not be able to grow as it does. Actuaries work in all sectors of the economy, though they are more heavily represented in the financial services sector, including the following.

- Insurance companies

- Commercial banks

- Investment banks

- Retirement funds

Actuaries are employed by corporations as well as the state and federal government. Many work also for consulting firms.

Some are self-employed, enjoying financially rewarding careers that also come with the great flexibility of being one's own boss.

The challenge to become an actuary

People in this field are expert in mathematical calculation. They have a solid understand of financial mathematics, probability, and statistics. Ever saw probability with triple integrals? I saw it and I am a survivor!

Their knowledge of probability and statistics is very deep. The work that they do in probability and statistics in based on calculus 1,2, and 3. A deep understanding of calculus is a must to do well!

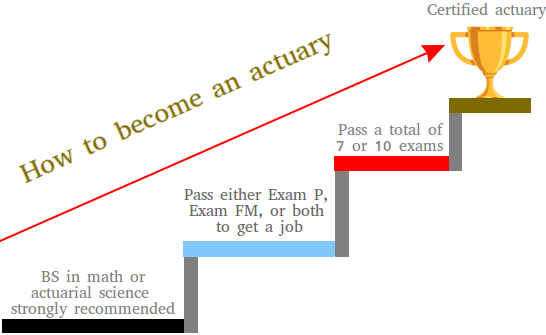

To become certified, one needs to take a series of top-notch examinations. The first one is probability called Exam P and the second is financial mathematics called Exam FM. See actuary exams for more information.

It is not required to pass all examinations at once to get a job. However, it is important to pass at least one or two to get a job.

Some places take people who passed at least once. However, since competition is tough, you may need to pass at least two examinations (usually Exam P and Exam FM). Don't give up on your dream to become an actuary if this what you really want to do. Try to pass at least two exams to increase your chance of getting a job.

It may take anywhere between 5 to 10 years to pass all examinations. For others it may take even longer depending on situations.

The amount of work that it takes to pass all exams may be immense or overwhelming. However, this job pays well. The minimum starting salary is usually at least 40,000 dollars. The more exams one pass, the more you get paid until you reach a six figure income and more!

Check out this website in order to find more information about salary.

Getting the job as an actuary

To find opening, you may need to use your research skills and take a proactive approach to search for openings with insurance, educational institutions, government agencies, financial institutions, computer software companies, and public relations firms.

Use internet, telephone directories, campus career services, and especially actuarial associations. Two well-known actuarial associations in the United States are Society of Actuary and Casualty Actuarial Society.

These will provide you with invaluable information about job openings. Usually, those job openings will tell you how many tests you should have passed to get your foot at the door.