Rule of 72

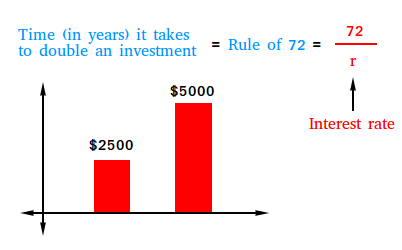

The famous "Rule of 72" states that roughly speaking, money will double in (72 / r) years when the money is invested at an annual compounded interest rate of r%.

Notice that according to the rule, we are not interested in the amount of money that you will have in your bank account when the money is doubled. We are interested in knowing when the money will be doubled.

For example, suppose you invest money and the compounded annual interest rate is 6%. How long will it take for the money to double?

The money will double in 72 / 6 years or 12 years.

Suppose instead you invest money and the compounded annual interest rate is 9%. How long will it take for the money to double?

The money will double in 72 / 9 years = 8 years

Finally, notice that it will take the same amount of time for the money to double regardless of the amount you invest as long as the interest rate is the same.

For example, 1 million dollars will take 8 years to double if the compounded annual interest rate is 9%.

By the same token, 100 dollars will take 8 years to double if the compounded annual interest rate is 9%.

However, the higher the interest rate, the faster the money will double.

On the other hand, the lower the interest rate, the more time it will take for the money to double.

For example, a rate of 1% interest will take 72 / 1 or 72 years to double. Imagine that!

Imagine you have a 100 dollars in a saving account at a local bank. If they offer 1% compounded annual interest, you will have to wait 72 years to see 200 dollars in the bank.

Yet most banks do not even offer 1%!

The rule of 72 is not always as accurate as we want it to be.

The rule of 72 gives a very good rough estimate that is close to the real answer when the interest rate is not a big number. However, we get undesired results as we increase the value of the interest rate.

For example, when the interest rate is 25%, according to the rule, it will take 2.88 years for the money to double. However, use the compound interest calculator and enter 25% in the field that says annual interest rate, 2.88 in the field that says time, and 1 in the field that says interest compounded.

You will notice that the answer is about $9015. Therefore, the rule of 72 is off by almost $1000.

Since even very risky investments do not usually offer a rate higher than 20%, the rule of 72 should give a good estimate as to when your money will double in many cases!