Simple Interest

When someone pays or receives simple interest (I), he or she pays or receives interest on the principal only, not on the interest that has already been paid. To find the interest you can use the following formula.

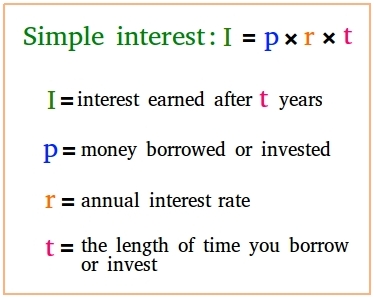

Simple interest formula

Interest = Principal × Interest rate × Time = Prt

- The principal is the amount of money you borrow or invest.

- The interest rate is the percent charged for the use of money.

- The time is the duration or the time the money is invested or borrowed in years.

To find the simple interest, just multiply the principal amount by the annual interest rate and the time.

What types of loans use simple interest?

Regarding car loans, personal loans, and student loans, the lender may use simple interest to figure out how much interest they should charge you.

As a borrower, it is always a good idea to ask the lender how you will pay interest. You may save money and pay less interest is simple interest is used. However, as an investor, you will want them to use compound interest in order to earn as much money as possible.

A few exercises showing how to compute or find the simple interest

Exercise #1:

Compute the interest if the principal amount is 2000 dollars at a rate of interest of 5% for 4 years.

I = p × r × t

p = 2000, r = 5%, and t = 4

Interest = 2000 × 5% × 4

Interest = 2000 × 0.05 × 4

Interest = 100 × 4 = 400

After 4 years, the simple interest on a 2000 principal is 400 dollars.

Exercise # 2

Suppose you inherited a lump sum of 2 millions dollars. Compute the interest if the principal amount is 2,000,000 dollars at a rate of interest of 4% for a year.

I = p × r × t

p = 2000,000, r = 4%, and t = 1

Interest = 2,000,000 × 4% × 1

Interest = 2,000,000 × 0.04 × 1

Interest = 80,000 × 1 = 80,000

If you have 2 millions dollars and your bank pays you 4% interest every year, you will earn 80,000 dollars every year.

Great, you can perhaps quit your day time job!

Exercise # 3

Compute the interest if the principal is 100 dollars at a rate of interest of 2% for 10 years.

I = p × r × t

p = 100, r = 2%, and t = 10

Interest = 100 × 2% × 10

Interest = 100 × 0.02 × 10

Interest = 2 × 10 = 20

With so little money invested and such low interest, 10 years investment gives you a mere 20 dollars. It is hard to imagine that some banks do not even give a rate of 2%. You may for instance get an interest rate of 0.05% from Bank of America. This might turn out to be a waste of time!

How to find the principal when the end balance is known

End balance = money invested + simple interest

Let P be the money invested

End balance = P + Prt

End balance = P(1 + rt)

Exercise # 4

The end balance of an auto loan after 5 years is 38150. Find the price of the car if the annual interest is 1.8 %.

Use r = 1.8% = 1.8/100 = 0.018

Use t = 5

End balance = P + Prt

38150 = P(1 + 0.018 × 5)

38150 = P(1 + 0.09)

38150 = P(1.09)

38150 / 1.09 = P

P = 35000

The price of the car is $35000.

How to find the annual interest rate

Exercise # 5

Find the annual percentage rate (APR) if the amount of money you invested in a company has doubled after 8 years.

Let P be the initial principal or the amount that you invested.

Then, the end balance is 2P.

End balance = P(1 + rt)

2P = P(1 + 8r)

2 = 1 + 8r

2 - 1 = 8r

1 = 8r

1/8 = r

r = 0.125

r = 12.5%

The APR is 12.5%

How to find the time when the total interest is known

Exercise # 6

How long does it take to get a total interest of $5760 if the principal is $16000 and the interest rate is 3%.

Interest = Principal × Interest rate × Time

5760 = 16000 × 3% × Time

5760 = 16000 × 0.03 × Time

5760 = 480 × Time

Time = 5760 / 480

Time = 12 years